Lack of Technology Commitment for Customer Service Proving Costly to Dealerships in Germany, J.D. Power Finds

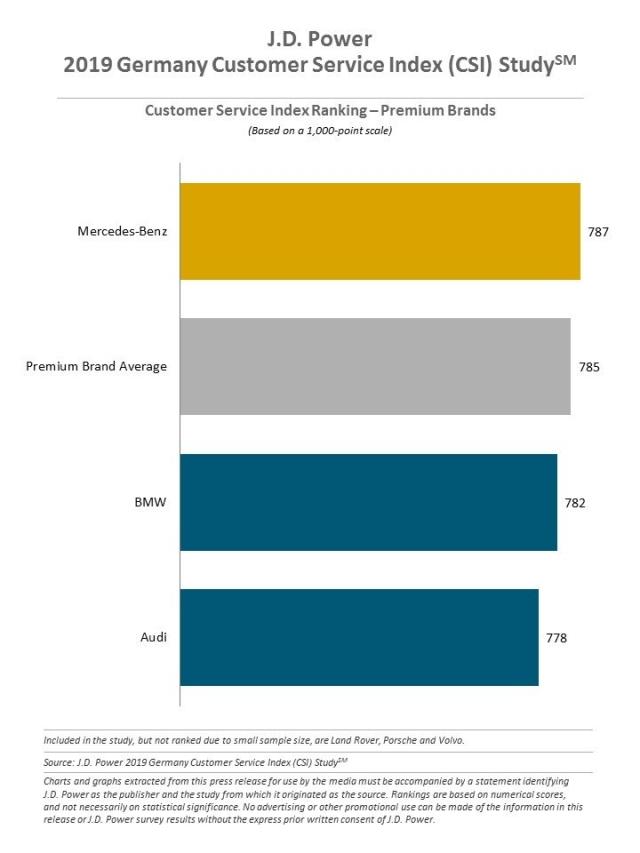

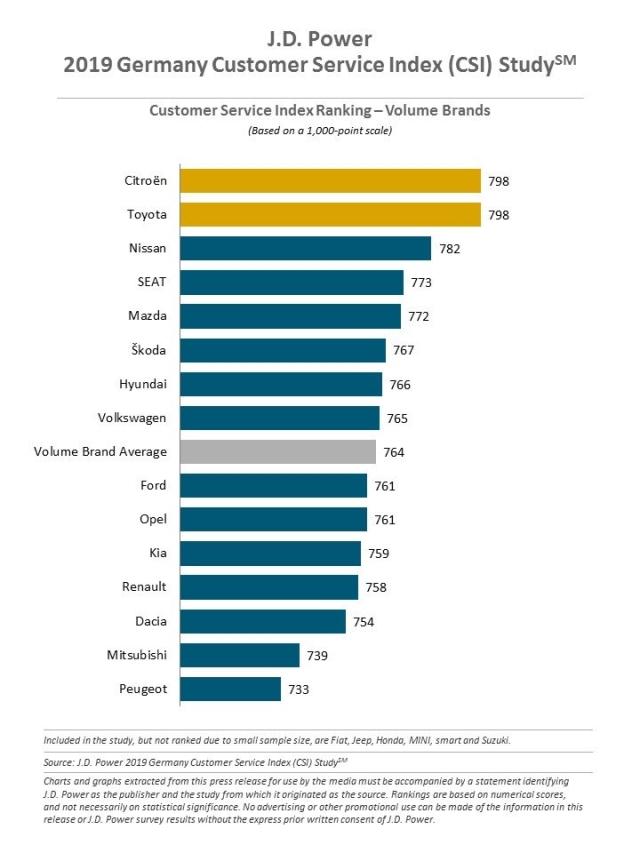

Mercedes-Benz Ranks Highest among Premium Brands; Citroën and Toyota Rank Highest among Volume Brands

MUNICH: 26 April 2019 — Forward-thinking dealers whose personnel use tablets during service inspections to show a menu of vehicle service options can boost customer loyalty and spend, according to the J.D Power 2019 Germany Customer Service Index (CSI) StudySM, released today.

On average, overall satisfaction is higher among dealers who use tablets in the service process, due in part to the transparency it creates for customers. For instance, when dealer personnel use a tablet in the service drive, overall satisfaction averages 812 (on a 1,000-point scale), 68 points higher than if a tablet isn’t used. More specifically, satisfaction with the vehicle pick-up is 74 points higher when a tablet is used (808 vs. 734, respectively).

“Customers respond to dealers using technology in a really positive way—and there’s a direct correlation to dealer profitability,” says Josh Halliburton, Vice President and Head of European Operations at J.D. Power. “Customers spend more when they believe their dealer is transparent about pricing and the work completed. Tablets can be instrumental to this transparency because they give customers confidence that the dealer is committed to a customer-first approach to servicing their vehicle.”

Slightly more than three-fourths (76%) of customers accepted additional work recommendations when the advisor knew their vehicle service history, and 78% accepted additional work when the dealer performed an assessment of components. Nearly three-fourths (71%) accepted additional work when the dealer provided an explanation of charges. However, the biggest driver to increased spend on additional work is when customers asked service personnel to explain the vehicle’s features or technology.

“When customers accept recommendations, they spend more than when no recommendations are made—typically €226 compared with average revenue of €178,” Halliburton said. “Despite what we see as a direct correlation among tablet use, satisfaction levels and increased spend, dealers are still slow to adopt technology to boost their business and win customer loyalty. For example, using a tablet when conducting inspections and showing a menu of service options are done only 22% and 14% of the time, respectively.”

Following are additional key findings of the 2019 study:

- Let the web take the strain: Younger customers have a stronger preference for internet scheduling, yet there has not been a significant increase in preference for internet scheduling among older generations during the past five years. There is a significant and relatively consistent gap between customers who prefer to book an appointment via the internet (14%) and actual internet scheduling (6%) behavior. Satisfaction is lowest among Gen Z1 customers, and they are more likely to visit a non-dealer for service (44%) than Boomers (12%). Increasing internet scheduling would align more closely to Gen Z customer desires and bring their satisfaction closer to that of other generations.

- Phone calls lose favour: Not unexpectedly, younger customers increasingly want to be contacted via text message or messaging app. While 41% of customers under 25 still prefer to be contacted via telephone, 31% of them want to receive a text or message via an app. This gap has significantly narrowed to 10 points from a 30-point gap in 2017.

- Convenience is king: Dealers who take the strain out of servicing by offering a valet pick-up service achieve higher overall satisfaction scores than those who rely on customers dropping off their vehicle themselves. Service initiation satisfaction among customers who use a valet pick-up service is 48 points higher than when such a service is not used.

- Helpful advice in Germany lags behind UK and United States: Service customers in Germany are far less likely to say that their advisor provided helpful advice than service customers in the UK and the United States. Notably, just 66% of service customers in Germany indicate their advisor provided helpful advice, compared with 86% of customers in the UK and 88% in the United States, according to the J.D. Power 2019 UK Customer Service Index (CSI) StudySM and the J.D. Power 2019 U.S. Customer Service Index (CSI) Study.SM

- Key comparisons: In comparing metrics across nations, German dealerships lag behind U.S. and U.K dealerships in arrival responsiveness, with service advisors in Germany speaking to customers within two minutes of arrival 49% of the time compared with 70% in the United States and 62% in the UK. However, German dealerships fall short in terms of contacting their customers after service is completed (44% in Germany, 65% in the United States and 62% in the UK). Just 60% of customers in Germany say that paperwork is finished and their vehicle is retrieved in 10 minutes or less, compared with 91% in the United States.

Highest-Ranked Brands

Mercedes-Benz ranks highest among premium brands, with a score of 787. Among volume brands, Citroën and Toyota rank highest in a tie with a score of 798. Nissan (782) ranks third.

The Germany Customer Service Index (CSI) Study, now in its fifth year, measures customer satisfaction with their service experience at a franchised dealer facility for maintenance and repair work. The study explores customer satisfaction with their service dealer by examining five measures (listed in order of importance): service quality (26%); service initiation (23%); service advisor (19%); vehicle pick-up (18%); and service facility (14%).

The study is based on data collected from 6,980 respondents who registered their new vehicle between November 2015 and January 2018. The study was fielded from November 2018 through January 2019.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe.

Media Relations Contacts

Ricky Vazquez, RVi Communications; London; +44(0)7501 589612; ricky.vazquez@rvicommunications.com

Geno Effler, J.D. Power; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

1J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.