Personal Recommendations Most Likely to Drive Young Customers’ Dealer Loyalty for Vehicle Servicing, J.D. Power Finds

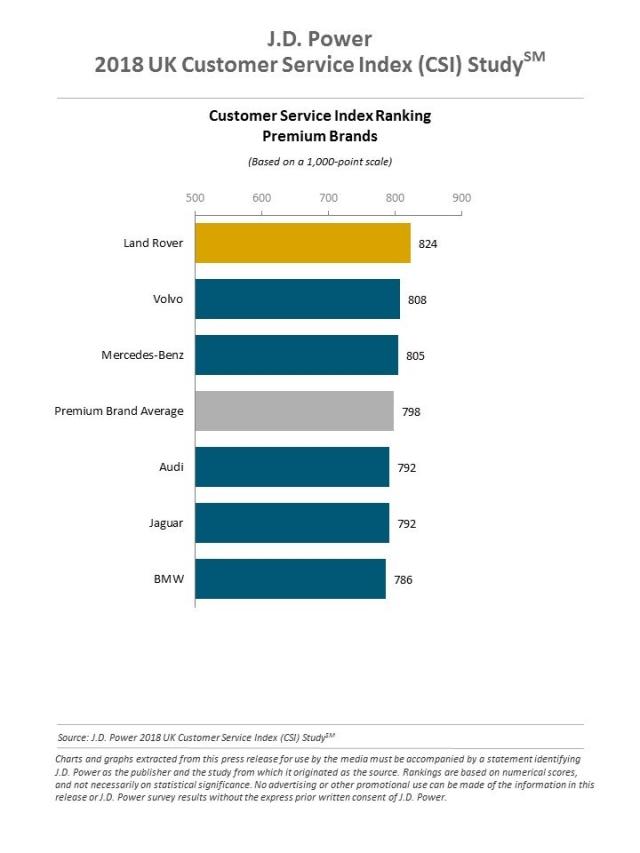

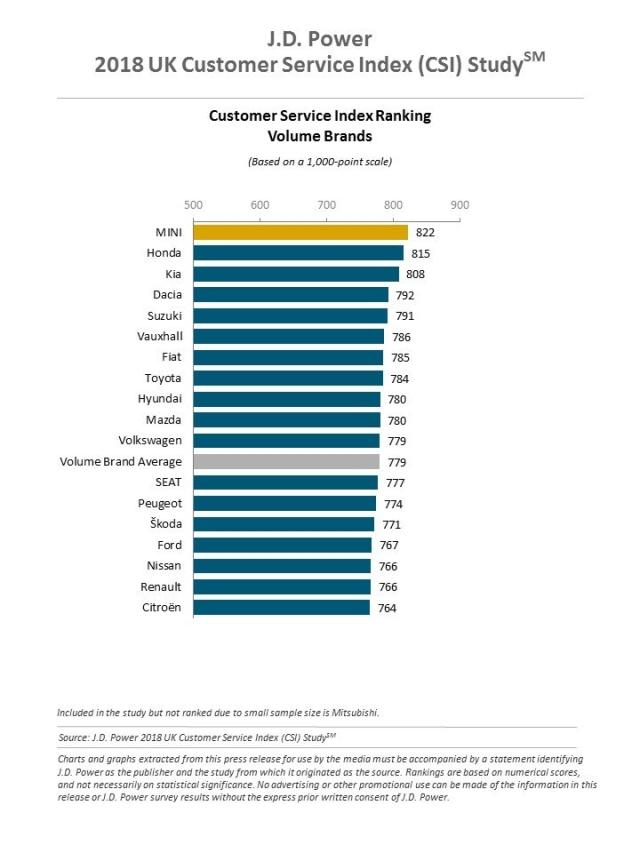

Land Rover Ranks Highest among Premium Brands; MINI Ranks Highest among Volume Brands

LONDON: 5 June 2018 — Young customers are less likely than older customers to have a dealer they are loyal to for service, so they rely more often on recommendations from friends and relatives when choosing a servicing dealer, according to the J.D. Power 2018 UK Customer Service Index (CSI) Study.SM Additionally, overall satisfaction scores, which are based on a 1,000-point scale, improve 12 points from 2017.

“These results illustrate the importance of developing passionate advocates, not only for the product but also for the dealership itself, when trying to attract younger people as new customers,” said Josh Halliburton, Vice President and Head of European Operations at J.D. Power. “Recommendations among customers in this group are far more important than dealership advertising, promotional materials or coupons.”

Another metric for dealers to consider is the Net Promoter Score® (NPS®)[1], new to the 2018 UK CSI, which measures customers’ likelihood to recommend both their vehicle make and model on a 0-10 scale. Customers are segmented into three groups: Detractor (0-6), Passive (7-8) or Promoter (9-10). NPS® is calculated by subtracting the percentage of Detractors from the percentage of Promoters. For example, the NPS® for the volume segment in this year’s study is 45 (54% Promoters vs. 9% Detractors).

Following are key findings of the 2018 study:

- Internet scheduling more satisfying than via phone: Service initiation satisfaction is higher among customers who schedule service over the internet (799) than among those who schedule via phone (792).

- Text message communication not meeting customers’ preferences: While text messaging and messaging app updates continue to be used more frequently to communicate with service customers (increasing by 2 percentage points and 1 percentage point, respectively, from the 2017 study), there is still a large gap between current usage and what customers prefer, particularly customers under the age of 40. Nearly one-third (30%) of customers prefer communication by text, but only 13% received that type of communication during their most recent service visit.

- Service advisors are key to customer satisfaction: Vehicle pick-up satisfaction is 15 points higher among customers who handled payment with their service advisor than among those who dealt with a cashier.

- Explanation of work and charges is time well spent: Satisfaction is higher among customers who have the work and charges explained for services performed on their vehicle even though it may take 11-15 minutes to complete their paperwork than among those customers who take less time to complete paperwork (0-5 minutes) and do not have the work and charges explained.

- Brand promoters are loyal customers: In addition to providing positive word of mouth recommendations to others, 64% of customers in the Promoter segment of the NPS “definitely will” return to their dealer for paid service work and 62% are likely to repurchase the same make of vehicle in the future.

Satisfaction and Brand Rankings

Land Rover ranks highest among premium brands for a second consecutive year, with a score of 824, a 16-point improvement from 2017. Land Rover is followed by Volvo (808) and Mercedes-Benz (805).

MINI ranks highest among volume brands, with a score of 822, a 37-point improvement from 2017. Honda ranks second (815), followed by Kia (808).

The study, now in its fourth year, measures customer satisfaction with their service experience at a franchised dealer facility for maintenance and repair work. The study explores customer satisfaction with their service dealer by examining five measures (listed in order of importance): service quality (26%); service initiation (23%); service advisor (19%); vehicle pick-up (17%); and service facility (16%).

The 2018 UK Customer Service Index Study is based on data collected from 7,899 respondents who registered their new vehicle between February 2015 and April 2017. The study was fielded in February-April 2018.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer.

Media Relations Contact

Michael Kelly; Edelman; London; +44 (0) 20 3047 2119; Michael.Kelly@edelman.com

Geno Effler; J.D. Power; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] Net Promoter,® Net Promoter System,® Net Promoter Score,® NPS,® and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.